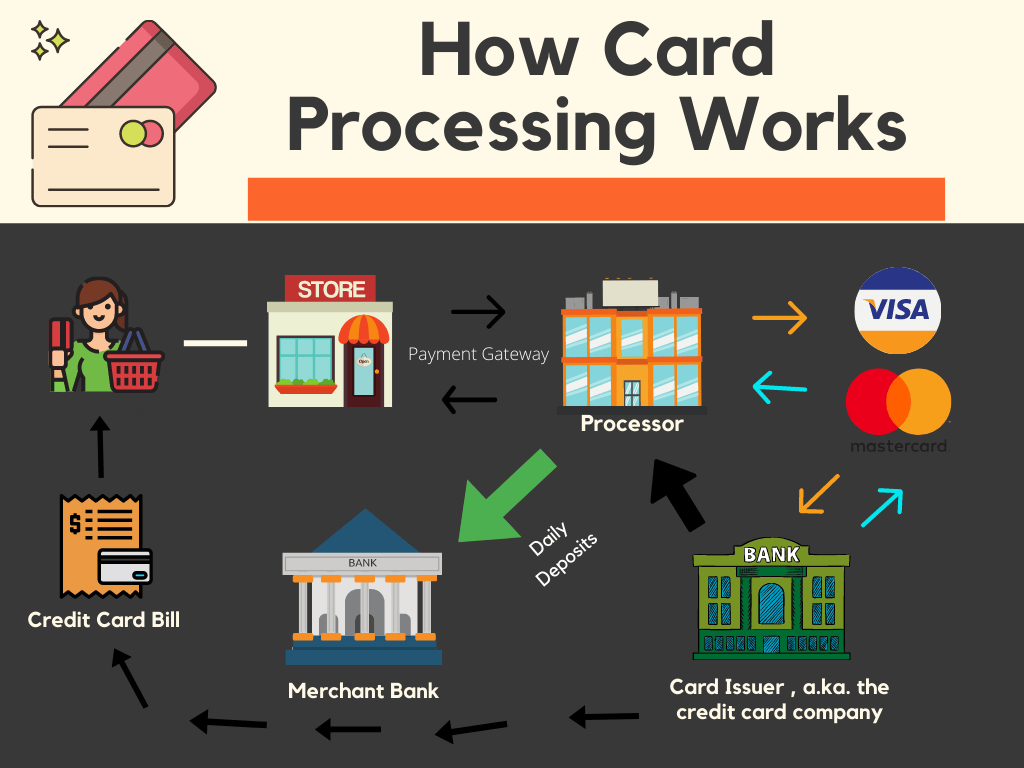

A bank card payment processor plays a crucial role in the present day financial landscape, providing as the linchpin that facilitates electric transactions between retailers and customers. These processors become intermediaries, connecting organizations with the banking process and permitting the seamless transfer of funds. The substance of the purpose lies in translating the data from a charge card deal in to a language clear by financial institutions, ensuring that funds are certified, refined, and settled efficiently.

One of many primary features of a charge card cost model is always to enhance the effectiveness of transactions. When a customer swipes, inserts, or shoes their credit card, the cost model rapidly assesses the deal facts, communicates with the relevant financial institutions, and validates whether the purchase can proceed. This method does occur in a subject of seconds, focusing the pace and real-time character of credit card payment processing.

Security is a paramount problem in the sphere of economic transactions, and credit card payment processors are in the front of employing measures to guard painful and sensitive information. Sophisticated encryption technologies and submission with business standards make sure that customer information stays protected through the payment process. These safety measures not only safeguard customers but in addition generate trust in companies adopting digital payment methods.

The charge card payment control environment is continuously changing, with processors adapting to scientific breakthroughs and adjusting customer preferences. Cellular funds, contactless transactions, and the integration of digital wallets signify the front of innovation in this domain. Bank card payment processors enjoy an essential position in enabling businesses to keep forward of these styles, providing the infrastructure needed to aid diverse cost methods.

Beyond the traditional brick-and-mortar retail space, bank card cost processors are crucial in running the large landscape of e-commerce. With the rise of online searching, processors help transactions in an electronic setting, handling the intricacies of card-not-present scenarios. The ability to seamlessly steer the difficulties of electronic commerce underscores the versatility and flexibility of bank card payment processors.

International commerce depends seriously on charge card cost processors to help transactions across borders. These processors handle currency conversions, address global submission needs, and ensure that companies can run on a global scale. The interconnectedness of economic methods, supported by credit card payment processors, has changed commerce right into a really borderless endeavor.

Credit card payment processors lead somewhat to the growth and sustainability of little businesses. By giving digital payment alternatives, these processors allow smaller enterprises to grow their customer bottom and compete on an amount enjoying subject with bigger counterparts. The supply and affordability of charge card payment processing services are becoming important enablers for entrepreneurial ventures.

The landscape of charge card payment processing also involves concerns of scam prevention and regulatory compliance. Payment processors apply effective methods to identify and prevent fraudulent activities, defending equally corporations and consumers. Moreover, remaining abreast of ever-evolving regulatory needs assures that transactions stick to legal standards, becoming a credit card processor the standing and reliability of the payment control industry.

In conclusion, credit card payment processors form the backbone of contemporary financial transactions, facilitating the smooth movement of resources between businesses and consumers. Their multifaceted position encompasses speed, security, adaptability to technological changes, and help for world wide commerce. As engineering continues to improve and consumer tastes evolve, credit card cost processors will remain main to the vibrant landscape of electric transactions, shaping the continuing future of commerce worldwide.